Trusts and Estate Planning in New York

Over a Decade of

Experience

New York State Bar Association (NYSBA) Member

Navigate New York State Regulations

Elder Law

Ensure your assets are protected & distributed according to your wishes

At Abraham Mazloumi & Associates, we understand that planning for the future can be complex. Our dedicated team provides comprehensive trusts and estate planning services in New York, helping you protect your legacy.

Our services encompass a wide range of estate planning tools, including:

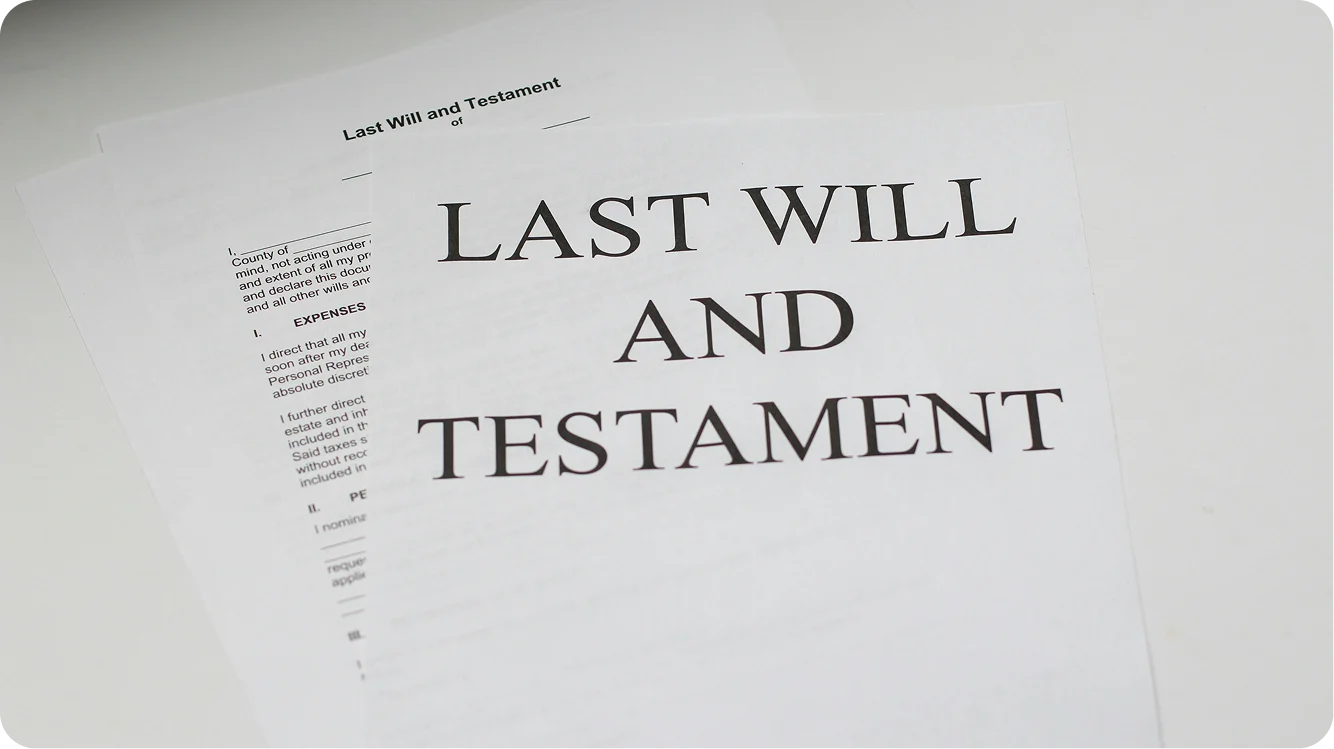

• Last Will and Testament: A fundamental estate planning document that allows you to designate beneficiaries, and appoint an executor to manage your estate. Without a will, New York State law dictates how your assets are distributed and who would manage your estate.

• Revocable Living Trusts: Providing flexibility and probate avoidance, these trusts allow you to maintain control over your assets during your lifetime while ensuring a smooth transfer to beneficiaries upon your passing. Also, you can place conditions, such as age restrictions that need to be satisfied before the trust beneficiaries get access to the trust assets.

• Irrevocable Trusts: Offering potential asset protection and potential estate tax benefits, irrevocable trusts can be tailored to meet specific needs, such as Medicaid planning or estate tax planning.

• Special Needs Trusts: Preserve government benefits while providing supplemental financial support for beneficiaries with disabilities.

• Probate and Estate Administration: We guide executors, administrators and beneficiaries through the often complex probate process or estate administration in Surrogate’s Court.

Our experienced attorneys will work closely with you to develop a customized estate plan that addresses your specific goals, whether you’re planning for incapacity, or ensuring a smooth transfer of assets to your heirs.

Trust and estate planning services tailored to you

Call us now for a

consultation

Revocable and irrevocable trusts

Revocable living trusts

A revocable living trust offers flexibility and control over assets that you transferred to your trust while avoiding probate upon your death.

As the grantor, trustee, and initial beneficiary, you manage the trust, maintaining full control during your lifetime (including changing beneficiaries, modifying, and even revoking the trust.)

Upon your passing, your successor trustee manages and distributes the trust assets to your heirs, bypassing the delays and costs of probate.

A pour-over will covers assets not owned by the trust at the time of death, ensuring they are transferred into the trust (after they have gone through probate) and managed by the trustee according to your wishes.

Irrevocable trusts

Irrevocable trusts offer significant benefits, including estate tax planning and asset protection from creditors.

Transferring assets into certain irrevocable trusts also removes them from your taxable estate, which can help reduce estate taxes.

This type of trust is a powerful tool for Medicaid planning, as assets placed in an irrevocable trust may remove your assets as a resource for Medicaid eligibility purposes. However, assets transferred to an irrevocable trust trigger the Medicaid look-back penalty periods. This requires careful consideration and professional legal guidance due to its permanence and legal complexity.

Trust and estate planning legal services in New York

Call us now for a

consultation

Trusts vs. wills

A will is needed to name your beneficiaries and to name an executor to oversee the distribution of your estate. However, trusts offer greater flexibility and control over your assets and their distribution (both during your lifetime and after your passing.)

- Protect assets: Safeguard your legacy from creditors and potential lawsuits.

- Avoid probate: Bypass probate for a smooth, private, and swift transfer of assets to beneficiaries.

- Plan for incapacity: Allow a successor trustee to manage your affairs in the event you become unable to do so, avoiding the need for guardianship proceedings.

- Address beneficiary contingencies: Protect assets in situations like divorce, bankruptcy, or disability.

- Control asset distribution: Dictate when and how beneficiaries receive their inheritance, such as based on age restrictions or upon meeting other conditions.

How it works

Initial Consultation

We’ll discuss your family’s needs, financial goals, and estate planning objectives.

Strategy

We’ll develop a customized plan using the most appropriate legal tools, such as wills and trusts.

Implementation

We handle all legal complexities & documentation, ensuring a smooth and stress-free experience.